Buying cannabis from a dispensary in the USA isn’t always simple. Many dispensaries don’t accept credit or debit cards because of federal laws. This means most people pay with cash. But other options, like debit card PIN payments, bank transfers, and even cryptocurrency, are becoming more common.

Knowing how to pay at a dispensary is important so you don’t run into problems at checkout. Some payment methods have extra fees, while others may not be available everywhere. As cannabis laws change, new payment options could make things easier. In this guide, we’ll explain the different ways to pay, their pros and cons, and what the future of cannabis payments might look like.

Key Points:

- Most dispensaries operate on a cash-only basis due to federal banking restrictions.

- Debit card transactions may be possible through cashless ATMs or PIN debit systems.

- Credit cards are rarely accepted due to banking regulations.

- Digital payments like cryptocurrency and app-based options are emerging.

- Some dispensaries offer prepaid options or store credit for convenience.

What Are the Challenges of Paying at Cannabis Dispensaries?

If you’ve ever tried to pay at a cannabis dispensary – especially as a medical patient – you’ve probably noticed that it’s not always as simple as it should be. Whether it’s confusion at the register or the “cash only” signs, paying can sometimes feel like a hassle. Here’s a look at why it’s still so complicated, and what that means for patients and dispensary owners alike.

Cannabis Laws: Federal vs. State

Cannabis is legal in many states, but the U.S. federal government still considers it illegal. This creates a problem because banks follow federal laws. Even if a dispensary is legal in its state, banks and credit card companies avoid working with them to avoid legal trouble.

Why Don’t Cannabis Dispensaries Accept Credit or Debit Cards?

Most dispensaries can’t accept credit or regular debit card payments because major banks and payment processors don’t want to be involved with cannabis sales. Some dispensaries use workarounds, like “cashless ATMs,” where a debit card is charged like a cash withdrawal. However, these methods can come with extra fees.

How Banking Rules Affect Dispensary Payments?

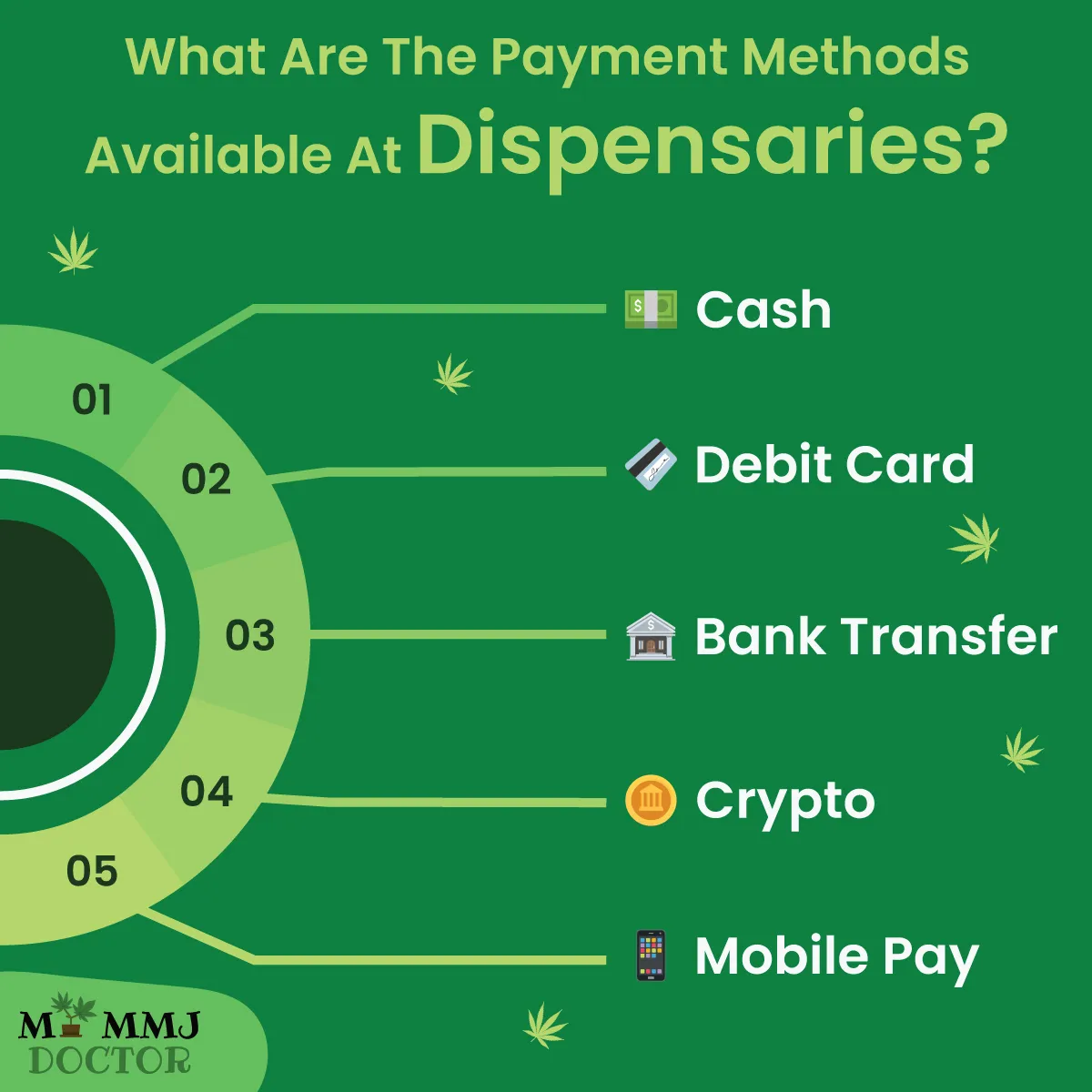

What are the payment Methods Available at Dispensaries?

Buying cannabis is different from shopping at a regular store because of banking restrictions. Many dispensaries have limited payment options, so it’s important to know how you can pay before you visit. Here’s a breakdown of the most common payment methods and what to expect with each one.

Points to Consider:

- Cash is the most common payment method because banks do not process cannabis transactions, but carrying cash can be inconvenient and unsafe.

- Debit card payments using cashless ATMs are available at some dispensaries, but they come with extra fees and face potential regulatory shutdowns.

- ACH transfers and cryptocurrency payments are emerging alternatives, though they are not widely accepted due to banking restrictions and price volatility.

- Mobile wallets and prepaid cards offer convenience in some dispensaries, but legal limitations still prevent widespread adoption of digital payments.

1. Cash Payments

1. Why is Cash the Most Common Method?

- Most dispensaries prefer cash because banks do not allow cannabis transactions through credit cards.

- Cash transactions are straightforward and do not involve third-party approval.

2. Benefits of Using Cash

- No extra fees or processing delays.

- Payments are private and secure.

3. Drawbacks of Using Cash

- Carrying large amounts of cash can be unsafe.

- Some dispensaries require exact change, which can be inconvenient.

4. ATMs Inside Dispensaries

- Many dispensaries have ATMs on-site for easy withdrawals.

- ATM fees may apply, increasing the overall cost of your purchase.

2. Debit Card Transactions (Cashless ATM/PIN Debit)

These systems let you use your debit card like you’re taking out cash, but there are often small fees and rounded-up charges. It might look like you’re paying with a card, but behind the scenes, it’s still treated like a cash withdrawal.

1. How “Cashless ATMs” Work?

- Some dispensaries allow debit card transactions using a cashless ATM system.

- The system charges your card in rounded amounts (for example, $60 instead of $57), and the dispensary gives you the remaining balance in cash.

2. Fees Associated with Debit Transactions

- Many dispensaries charge a small processing fee for debit transactions.

- Some banks may add additional fees for ATM-style transactions.

3. Regulatory Risks

- Some financial institutions are shutting down cashless ATMs due to legal concerns.

- This payment method may not always be available.

3. ACH Transfers & Bank-to-Bank Payments

This method lets customers pay directly from their bank account, similar to how you’d pay a bill online. It’s safer than carrying cash and helps dispensaries avoid handling large amounts of money. However, not all dispensaries offer this yet, and some patients may find the setup process a bit unfamiliar.

1. How ACH Transfers Work?

- ACH (Automated Clearing House) payments allow customers to link their bank accounts and pay electronically.

- This method does not require cash or cards, making it a convenient option where available.

2. Security and Reliability?

- ACH transfers are safer than carrying cash and help reduce fraud risk.

- Payments may take a few days to process, so they are not instant.

3. Dispensaries That Support ACH Payments

- Some online dispensaries accept ACH transfers for cannabis purchases.

- Not all dispensaries offer this option due to banking restrictions.

4. Cryptocurrency & Digital Payments

1. Using Bitcoin, Ethereum, and Other Cryptocurrencies

- A few dispensaries accept cryptocurrency as payment.

- Cryptocurrency transactions do not involve banks, making them an alternative for digital payments.

2. Challenges with Cryptocurrency Payments

- Cryptocurrency values can change rapidly, which may affect how much you need to pay.

- Not all dispensaries accept crypto, so checking ahead is necessary.

3. Dispensaries Accepting Cryptocurrency

- Some dispensaries partner with third-party services to process crypto payments.

- The number of businesses accepting cryptocurrency is growing, but remains limited.

5. Mobile Wallets & Prepaid Cards

These allow customers to load money onto a digital app or physical card ahead of time, making the checkout process quicker and safer than carrying cash. While not yet available everywhere, they’re becoming a popular alternative where allowed.

1. Using Apple Pay, Google Pay, and Other Digital Wallets

- Some dispensaries accept mobile payments, but they often require linking to a debit account.

- Due to banking restrictions, many digital wallet transactions are not allowed for cannabis purchases.

2. Prepaid Cards and Loyalty Programs

- Some dispensaries offer prepaid cards that customers can load with money and use for purchases.

- Loyalty programs may provide store credit or discounts for future transactions.

3. Future of Mobile Payments in Dispensaries

- As cannabis laws evolve, mobile payment options may become more widely accepted.

- The industry is working on cashless payment solutions to make transactions easier and safer.

What are the Risks & Scams to Avoid While Paying?

1. Be Careful with Unregulated Payment Processors

- Some dispensaries use third-party payment services that are not properly regulated.

- These processors may charge high fees, delay transactions, or even disappear with your money.

- Always check if the dispensary uses a trusted payment provider with positive customer reviews.

2. Watch Out for Fake Dispensary Payment Links

- Always visit state approved dispensaries and to know more about cannabis dispensaries, you can visit MY MMJ Doctor or the state medical marijuana program website.

- If a dispensary asks for an online payment, make sure the website is secure (look for “https://” in the URL).

- Never share your banking details unless you are sure the dispensary is legitimate.

3. How to Verify a Secure Transaction

- Ask the dispensary what payment methods they accept before your visit.

- Check if they have a physical store or a well-reviewed online presence.

- Avoid sketchy payment apps or services that seem too good to be true.

Future of Cannabis Payment Solutions:

1. Banking Reforms & the SAFE Banking Act

- The SAFE Banking Act is a proposed law that could allow banks to work with cannabis businesses without fear of federal penalties.

- If passed, dispensaries could accept credit and debit cards like regular businesses.

- This would make payments easier, safer, and more convenient for both dispensaries and customers.

2. Growth of Cannabis-Friendly Financial Services

- Some banks and payment processors now offer services designed for dispensaries.

- For example, Dama Financial is a cannabis-focused financial service provider that offers secure banking, payment processing, and cash management solutions for dispensaries. They help businesses operate more safely and stay within legal boundaries while giving customers more ways to pay.

- Mobile payment apps and cannabis-specific debit cards are becoming more popular.

- More companies may enter the market if federal restrictions loosen.

3. Federal Legalization & Its Impact on Payments

- If cannabis becomes legal nationwide, banks and major credit card companies would likely start processing payments.

- Dispensaries could offer more digital payment options, reducing the need for cash.

- Customers would have a smoother and more secure buying experience.

Tips for Choosing the Best Payment Method:

- Check ahead – Call the dispensary or check their website for accepted payment options.

- Bring cash as a backup – ATMs may be available, but fees can be high.

- Be cautious with digital payments – Some third-party processors aren’t always secure.

As cannabis laws continue to evolve, better and safer payment methods may become available. Until then, knowing your options will help you shop with confidence.

Conclusion

Paying at a cannabis dispensary isn’t as simple as a regular store purchase, but there are multiple ways to do it. Cash is still the most widely accepted option, while debit card PIN payments, ACH transfers, and even cryptocurrency are growing in popularity. Some dispensaries also offer mobile payment options – just be sure to check ahead and choose the method that works best and most reliably for you.

FAQs

- What are the most common payment methods at cannabis dispensaries in the USA?

Most dispensaries rely on cash due to federal banking restrictions. However, many now also offer cashless ATM transactions, which allow you to use a debit card to withdraw cash onsite. Some locations are beginning to accept ACH transfers and even digital payment options like cryptocurrency and mobile wallets. Each method has its pros and cons, so it’s best to verify available options before your visit.

- Can caregivers pay on behalf of registered medical marijuana patients?

Yes, caregivers can pay on behalf of registered medical marijuana patients, provided they are officially designated and approved through the state’s medical marijuana program. Most state laws allow caregivers to act on behalf of the patient in various capacities, including purchasing and paying for medical marijuana products. The caregiver must be listed in the patient’s registration and comply with all relevant regulations to legally make payments and handle transactions on the patient’s behalf.

- How do cashless ATM and debit card transactions work at cannabis dispensaries?

Cashless ATMs let you use your debit card to pay without physically withdrawing cash in advance. The system charges a rounded-up amount, and the difference is returned to you in cash. This workaround reduces the amount of cash you need to carry, though it may include small processing fees and isn’t available at every dispensary.

- Are medical marijuana purchases eligible for health savings accounts (HSAs) or FSAs?

No, medical marijuana purchases are not eligible for reimbursement through Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), even if recommended by a physician and legal under state law. This is because the IRS does not recognize marijuana as a qualified medical expense under federal law, as it remains classified as a Schedule I controlled substance. Therefore, using HSA or FSA funds for medical marijuana would be considered a non-qualified expense and could result in tax penalties.

- Can I use cryptocurrency to pay for cannabis at dispensaries?

A few dispensaries are beginning to accept cryptocurrencies like Bitcoin or Ethereum. This option bypasses traditional banking channels, making it an attractive alternative for some consumers. However, due to price volatility and limited acceptance, it’s important to confirm with your local dispensary before planning to use crypto as your payment method.

- Do dispensaries charge different fees for medical vs. recreational patients?

Yes, dispensaries often charge different fees for medical versus recreational patients. Medical marijuana patients typically pay less because they are exempt from certain state and local taxes that apply to recreational sales. Additionally, medical patients may have access to higher potency products, larger purchase limits, and discounted pricing set by the dispensary. However, pricing policies can vary by state and dispensary, so it’s important to check local regulations and individual dispensary practices.

- How will the SAFE Banking Act impact payment options at cannabis dispensaries?

The SAFE Banking Act aims to allow banks to work with cannabis businesses without federal penalties. If passed, this could enable dispensaries to accept credit and debit cards, reducing their reliance on cash. Improved banking access would likely lead to more secure, convenient, and diverse payment methods for consumers in the cannabis market.

- Can I buy cannabis online through platforms like mymmjdoctor.com?

No, You can use our platform, mymmjdoctor.com to obtain a medical marijuana recommendation, but you cannot legally purchase cannabis directly through the site. We connect you with licensed medical professionals for evaluations and help you get certified for medical marijuana in your state, after which you can purchase cannabis from licensed dispensaries or state-approved delivery services, depending on local laws.

Related Articles

How to Get a Medical Marijuana Card in Maryland?

How Can You Obtain Your Medical Marijuana Card in Maryland in 2025?Are you a Maryland resident seeking a way to manage your symptoms naturally? You came to the right place. Maryland has a medical marijuana program that allows eligible...

Benefits You Are Missing Without a Michigan MMJ Card

Top Benefits of a Michigan Medical Marijuana CardIf you live in Michigan and already use cannabis, you likely know it’s easy to access. However, many people don’t realize that having a Michigan medical marijuana (MMJ) card offers additional...

What are the Michigan Medical Marijuana Laws?

What are the Michigan Medical Marijuana Laws?Medical marijuana has been legal in Michigan since 2008, helping thousands of residents manage chronic pain, anxiety, cancer symptoms, and more. But knowing what’s allowed - and what’s not - can...

0 Comments